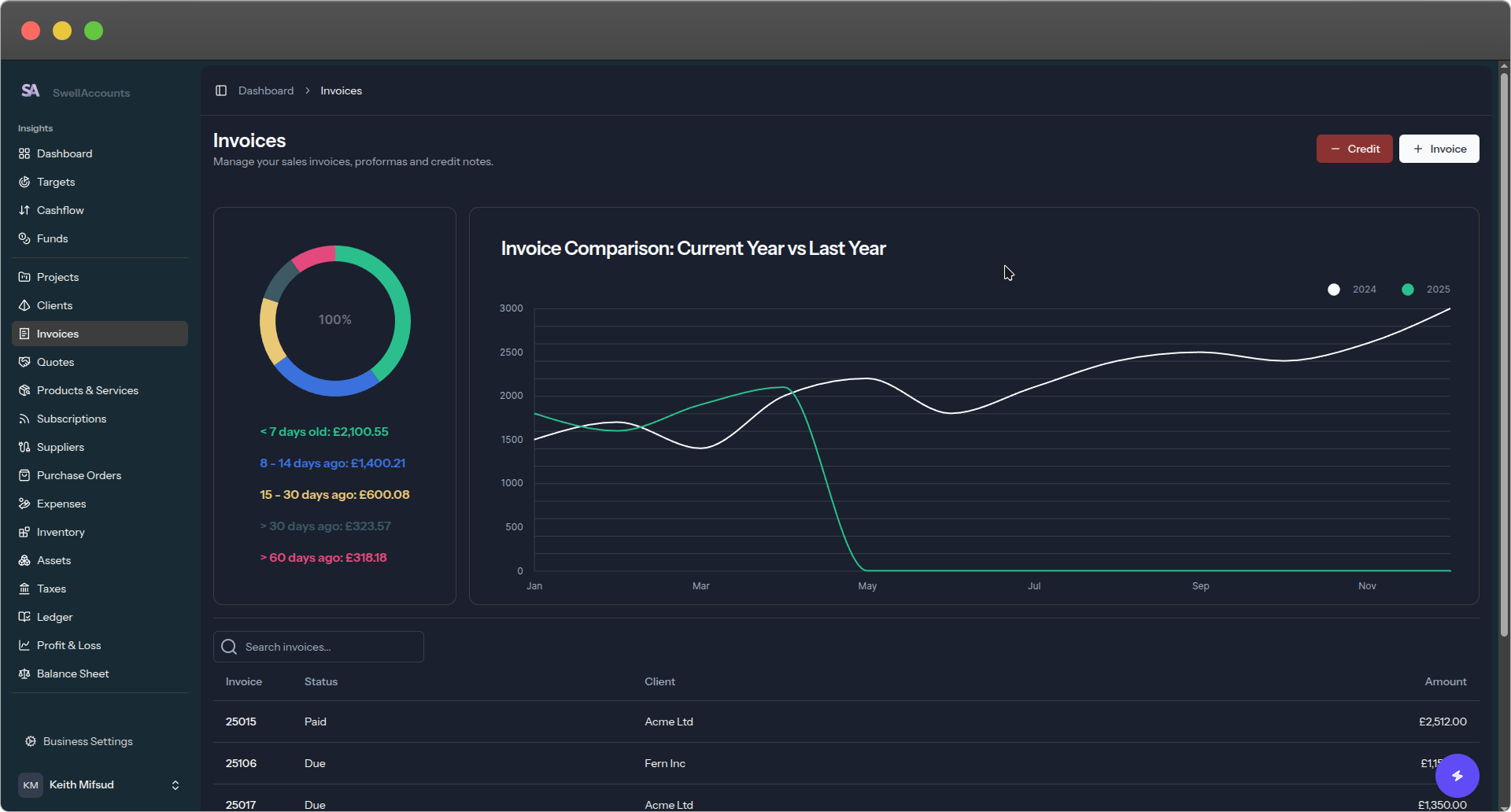

Prompt payments, Less admin.

SwellAccounts helps your projects bring in the money, stay tax ready, and keep cashflow under control.

Know where you stand. Know what comes next.

You handle the work. SwellAccounts keeps things steady so you’re not carrying the money side on your own.

Why SwellAccounts is a better way to manage your business money?

Stay on top of your business, not buried under it

Connects with the systems that power your business

From project management to banking, SwellAccounts connects with the tools you already use

Straightforward pricing for the way you work

All plans include every feature and free accountant access — no upsells, no missing pieces.

FAQs

What makes SwellAccounts different from other accounting software?

SwellAccounts is a full accounting system built for freelancers and small businesses — not just billing. It handles invoicing, expenses, supplier payments, bank reconciliation, tax calculations, and financial reports. But what really sets it apart is how easy it is to use. With built-in AI assistants, you can manage everything through simple prompts, without getting lost in menus or accounting jargon.

Can I use SwellAccounts if I’m not based in the UK?

Yes. SwellAccounts works internationally and supports multiple currencies. While it includes features tailored for UK businesses — like integrations with Companies House and HMRC — the core tools for invoicing, expense tracking, and financial reporting work anywhere.

How does SwellAccounts connect to my bank accounts?

SwellAccounts connects securely to your bank accounts and services like Revolut and Wise using regulated APIs. Transactions sync automatically, so you can track balances, categorise spending, and manage cash flow without switching between platforms. We’re also working on adding more bank integrations soon.

Is SwellAccounts suitable for freelancers and small teams?

Yes. SwellAccounts is built with freelancers, agencies, and small firms in mind. Whether you’re managing one business or several, it helps you stay organised, send invoices, track expenses, and keep an eye on your financial health — all without the overwhelm. Our plans are designed to be simple, with pricing that fits the size of your business.

Do I still need an accountant if I use SwellAccounts?

Every business has its own needs. SwellAccounts helps you handle day-to-day finances, calculate taxes, and stay organised — but depending on your situation, you may still want an accountant for advice or filings. All plans include free accountant access, so your accountant can securely log in, review your books, and support you when needed.

What happens to my data if I cancel or switch platforms?

Your data is always yours. If you cancel your subscription, you can export your financial records anytime. We store your information securely and will never delete anything without notice — but if you’d like your data removed, we’ll permanently delete it upon request. There are no hidden fees or lock-ins — just a clean exit if you ever need it.